Buy-to-let landlords in the North West get the highest rental returns

?>A report from specialist lender Kent Reliance reveals that landlords in the North West of England are earning the best rental returns on buy-to-let in the UK, followed by those invested in Yorkshire and the East Midlands.

The North West delivers the best returns with average yields of 6.2%. Yorkshire and the Humber follow delivering yields of 5.9%, followed again by the East Midlands with yields of 5.4%.

The report measured prospective rent against the cost of buying a property at current market prices, however, long-term buy-to-let investors are likely to be earning even greater rental returns.

Buy-to-let yields by region: Landlords in the north can still earn very decent returns

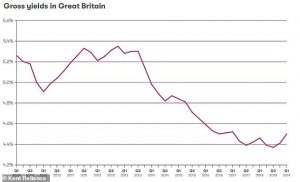

On a national level, the average yield now stands at 4.5%, the highest since March 2017, and up from 4.40% at the end of 2018.

Landlords are turning to multiple occupation homes

While low house prices are the obvious contributor to high yields but another reason is student accommodation which provides landlords ample opportunity to invest in houses in multiple occupation, or HMOs,

According to Kent Reliance’s ‘Buy-to-let Britain’ report, landlords are increasingly looking to HMOs to boost profits, with one in five landlords now holding an HMO property in their portfolio.

While this type of property may carry additional risks and regulations, have higher tenant turnover and are likely to require higher upkeep costs, they do generate higher levels of income.

In fact, the average yield for an HMO is one fifth higher than for a typical rental property, according to Kent Reliance.

Are landlords doing better or worse?

There has been a small uptick in average yields in the past year, taking a slightly longer view average national yields have dropped from 5.3% in 2012 to 4.5% today as house price growth outpaces rent growth.

According to the latest figures from the Royal Institution of Chartered Surveyors, a fall in the supply of private rented housing is likely to push rents up in the coming months as demand from prospective tenants increases.

But there’s more than just reduced rental yields that are making the sector less attractive to property investors.

But there’s more than just reduced rental yields that are making the sector less attractive to property investors.

Overall private rental sector growth has stalled in recent years due to tax and regulatory changes.

Recent months have seen the introduction of a ban on tenant fees, deposit caps, and the proposed curbing of eviction powers for landlords. A survey of 827 landlords run by Kent Reliance found that as a result just 37% now hold a positive outlook for their portfolio over the next 12 months. The report found that 18% of landlords expect to reduce their portfolio size over the next year while just 16% expect to expand it.