Funding a Care Home

The United Kingdom has a shortfall of care homes. The number of people aged over eighty in the UK is forecast to increase by 1.1 million in the next decade to a total of 4.5 million. This translates to a demand of an additional 144,000 care home beds over the next 10 years, or 14,400 new beds per annum, just to keep pace with population growth.

Financiers are increasingly recognising the strong supply and demand fundamentals make this a key growth asset class. While there are many sources of capital in the market to acquire, build or refinance a care home, the process for funding is complex because there are many factors which influence the funding decision.

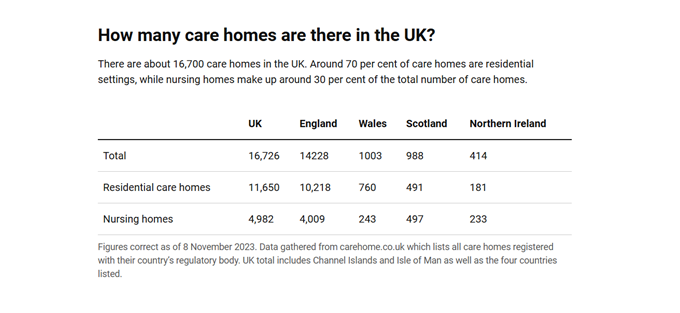

There are currently around 18,000 care homes in the UK, split between residential care homes and nursing homes.

Source: savills—uk-care-home-development-2023-spotlight.pdf

Lenders have different lending criteria. To have the best chance of finding finance use a broker to navigate the market. As well as traditional banks, commercial lenders and debt funds, there are investors with hybrid capital that will support development opportunities and a good broker will have access to all these types of funders.

How much can you borrow?

Care home loans can be secured on the bricks and mortar of the care home, the operational business, and the assets of the owners.

A lender ensures their risk is covered so in the case of any default they can fully recover their loan. This means that the amount they lend will be dependent on their risk appetite. This varies, the lower the loan to value (LTV), the better the pricing. A LTV of around 40-55% is where most lenders are comfortable, but some will fund up to 80-90%, the higher risk will reflect the pricing. There are also funders that will fund acquisitions up to 100% with bespoke lending structures.

Terms can vary, typically the main lenders will offer 15–20-year terms and commercial lenders can amortise up to 25-30 years. Interest only options are available.

Acquiring an operating care home or group

An operational care home generates income from day one, while this can make it easier to get funding there are still some obstacles. Funders prefer experienced owners and directors because they want to be confident that the current profitability will continue or improve, but there are however, a select number of lenders for first-time buyers.

A lender will usually do due diligence on the prospective owners, directors and the business. The owner’s experience, financial history, personal financial commitments and overall net worth are considered as part of the lending decision in addition to the financial and operational plans for the business.

The information and standard of presentation is vital and is often the reason for the decline itself. If a proposal is declined it is unlikely to be re-visited by the same lender in the short-term, so it is important to get it right first time. Always use a good broker, solicitor, and accountant to get the best possible outcome for your project.

Setting up a new care home

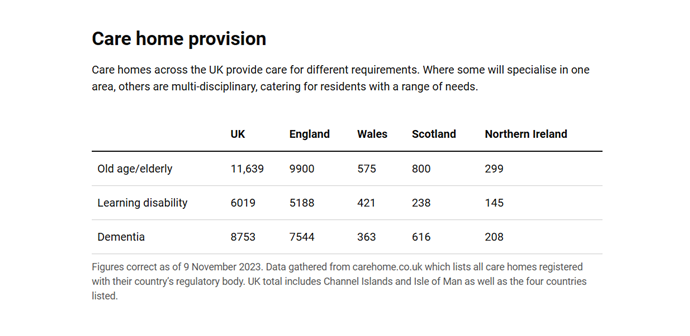

Finding a suitable property is key, some lenders will only fund purpose built care homes with en-suite facilities. So, the type of property you choose will determine the lenders you can approach. The same goes for the type of residents you intend to care for and their specialist needs. Care home provisions can be generally classified into elderly care, learning impaired and dementia care.

Source: Care home stats: number of settings, population & workforce – carehome.co.uk advice

Facilities such as wider doors, access ramps, lifts, fire doors and stairs, are expensive to retro fit and some properties may require substantial refurbishment. These costs, as well as the acquisition costs and furnishing the property can be financed with a variety of funding solutions, known as jigsaw loans.

Mortgage lenders want to see that the profits cover ‘all’ debt in the business, so a new operation will likely need an interim solution until the business is profitable.

Jigsaw Loans

Jigsaw loans are a bespoke package of capital from various sources, providing appropriate funding for each purpose. This could typically include a commercial mortgage, term loans for development capital and asset finance to provide equipment, fixtures, and fittings. In addition, it may be possible to arrange working capital to support cashflow while the occupancy levels stabilise.

The Proposal Process

All applications for mortgages are evaluated individually. The lender will want to see the historical accounts as well as financial projections, your business plan, your CV and the CV for all key personnel. Demonstrating prior experience in the care sector is crucial for a care home mortgage application. Lenders are more inclined to approve a loan if you can prove industry experience.

Some of the main risks lenders will want to see mitigated in your business plan include:

- Regulatory compliance

- Experienced management

- Multiple asset risk mitigation

- High energy costs

- Staff retention and recruitment policy

- Higher costs of capital than pre-covid era

The healthcare sector is heavily regulated, and care homes are monitored by the Care Quality Commission (CQC) which safeguards residents. Every care home security must comply with Care Quality Commission guidelines, The CQC rating is fundamental for lenders, they will not lend where there is any risk or impairment to the asset ‘Good’ ratings are vital for a long-term mortgage.

If the business is a new enterprise or has recently been downgraded there are interim funding options available until the asset becomes mortgageable.

To show a prospective lender you can navigate and mitigate these risks a lender will require a business plan and risk assessment. Your broker can give you guidance on these documents so contact one at an early stage.

Just as no two care homes are the same, so no two care home proposals are the same. The type of facility you are buying, its location, revenue streams, existing debt and its cashflow will help to determine the type of loan you need. Matching your requirement to the right loan is critical.

Summary

Care home mortgages and finance are a niche area, lenders have varying rules for proposals. All financiers partner with brokers and collaborating with a broker increases your chances of success in the first application attempt.

Scouring the market yourself can take a huge amount of time and lenders do not make decisions quickly, it can take weeks and even months to get an approval, and acquisitions often fall over due to slow progress with the funding application and the purchase process.

For the best chance of securing a good deal and acting on it timely, find a good broker with experience of funding these types of businesses and who can access care home finance and mortgages from a wide range of lenders. Save yourself all those cold calls and endless demands for information and avoid the credit repercussions of unsuccessful applications.

York Lane Finance work with businesses at all stages, from first-time purchasers to multi-asset groups. We are completely independent of all lenders and cover the entire range from High Street banks to complex specialist loan providers, including private capital. Simply tell us what you need and leave the rest to us.

Call – 07534 186 689 – avail 7 days

The information on this website is not specific for each individual reader and therefore does not constitute financial advice.